This Best Practice was first published in the Gender Intelligence Report 2023.

In today’s society, women continue to face misconceptions, myths, and societal biases surrounding their financial confidence. These biases often begin during their school years, with stereotypes such as ‘boys are better at math’ shaping the belief that women are less naturally inclined towards financial matters. As a result, many women perceive themselves as having less financial knowledge and confidence compared to their male counterparts. However, the truth is that women are indeed interested in managing their finances. Unfortunately, societal perceptions and expectations can hinder their decision-making and control over financial matters, especially in partnerships and marriages. The 2019 UBS Own Your Worth Study emphasizes the prevailing perception in Switzerland that men are primarily responsible for financial decisions, leading many women to relinquish control over their financial lives.

At Zurich Insurance, we believe that financial security is vital for long-term well-being and independence. In fact, financial well-being is one of the pillars of Zurich Insurance’s well-being framework, which is anchored in Zurich Insurance Switzerland’s Employee Promise and Corporate Strategy. That’s why we’ve developed a number of initiatives, including the multi-module WIN Financial Awareness Program, a pilot orchestrated by Zurich Insurance’s Employee Resource Group ’Women Innovation Network (WIN)’, along with workshops, seminars, events, podcasts, and personalized financial planning services. Each is designed to equip our employees with the tools, knowledge, and support they need. Through the combination of all elements, we foster a supportive community and ensure access to personalized financial guidance.

Zurich Insurance is committed to overcoming financial inequalities, supporting women in significant life events, addressing knowledge and confidence gaps, and tackling specific financial risks, all with the aim of promoting financial independence for women.

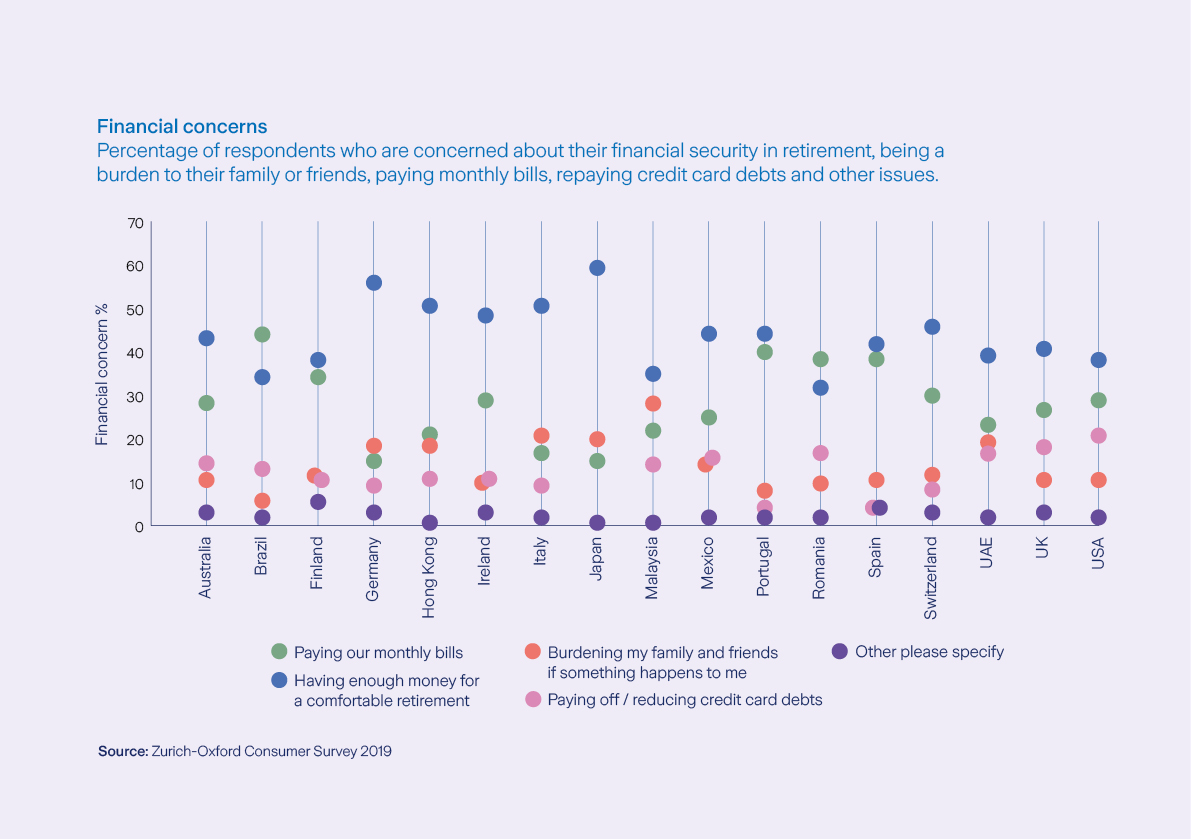

Retirement concerns in Switzerland: 44% rank it as a primary financial worry (highlighted by blue point) – third highest in Europe.

Head of Insurance Development Forum Engagement at Zurich Insurance Company Ltd.

To break the barriers, we have developed a comprehensive financial education curriculum, including the WIN Financial Awareness Program. Simone Hoffmann, IT Supplier Manager and co-creator of the program, shares her motivation for initiating the program and her personal insights: “During my own financial journey, I realized that money is much more than just budgeting for income and expenses. Having money means having freedom, choices, and independence. Taking the time to educate myself about money, set my goals, and prioritize my expenses was not a sacrifice; it was one of the best things I ever did!”

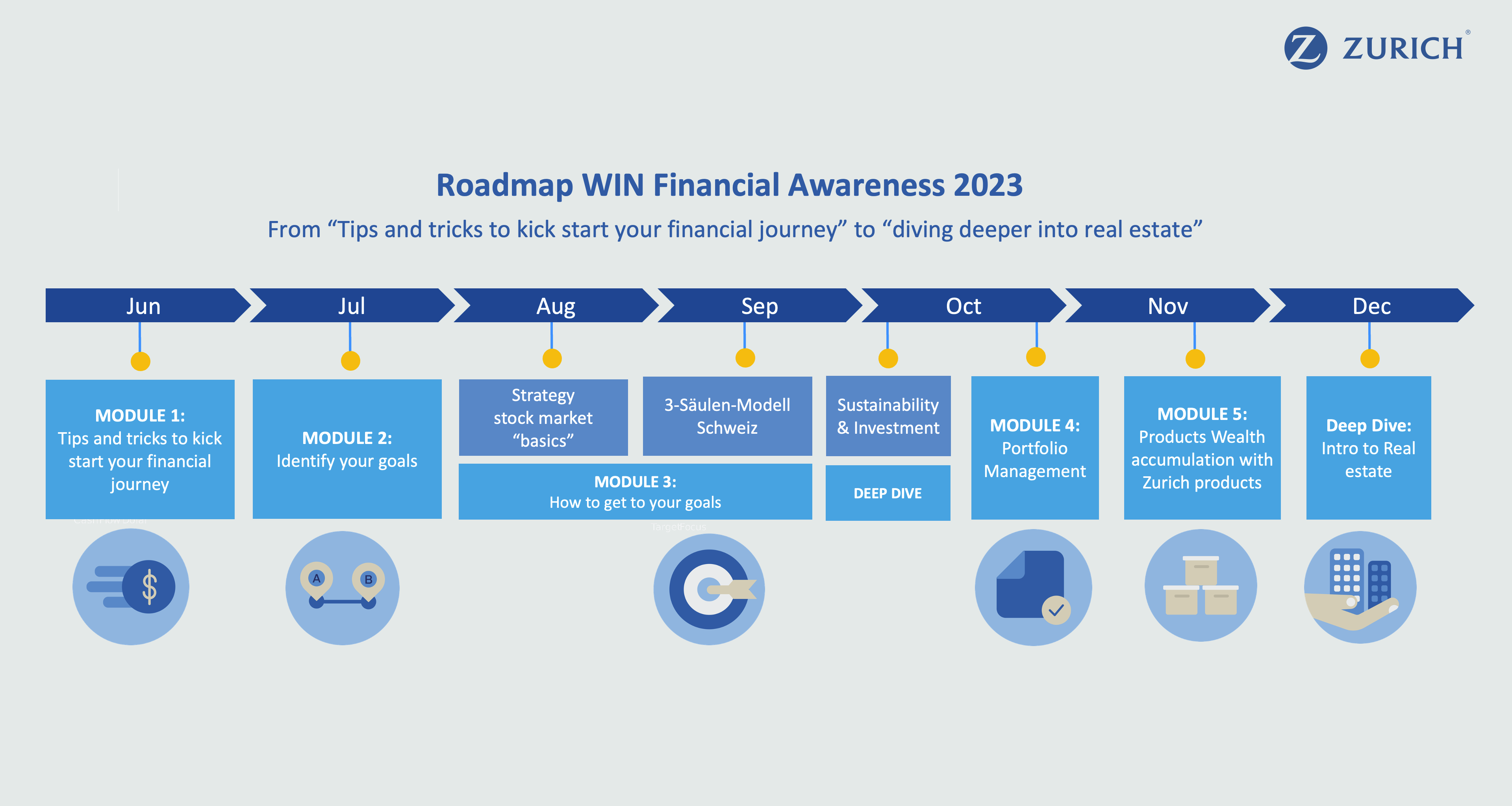

The WIN Financial Awareness Program provides the building blocks to address your financial insecurities and covers a wide range of topics, from budgeting and saving to investing and retirement planning. Our interactive workshops, seminars, and online resources ensure that every participant can learn at their own pace and convenience.

Roadmap of WIN Financial Awareness Program: five modules and two deep dives.

Furthermore, experts and representatives from different business areas organize events such as the Vorsorge-Wochen to encourage employees to focus on their retirement planning in a positive environment, benefiting from top-notch advice and personalized support. In collaboration with Finfluencer ‘Miss Finance,’ we also co-produced two podcasts on the impact of marriage on pension planning and saving for big dreams, providing valuable insights for women.

Creating a supportive and inclusive learning environment is crucial for the success of our financial education offering. We encourage active engagement, discussions, and the sharing of perspectives. At Zurich Insurance, we foster an environment free from judgment, where women feel comfortable discussing their financial concerns and seeking guidance. Together, we can create a safe space for learning and growth.

Our offerings provide the foundation for a greater financial understanding. However, we understand that each woman’s financial situation is unique. That’s why we offer personalized financial planning services through our in-house agency, connecting individuals with qualified advisors – trained on how to have conversations with females, which may differ from traditional conversations with males – who assess their individual circumstances and develop customized financial plans that help them navigate key life events, such as marriage, starting a family, or career transitions.

The increasing number of participants in our initiatives reflects a significant and growing interest in financial education within Zurich Insurance Company. For example, word has spread about the WIN Financial Awareness Program’s effectiveness and relevance, leading to a notable rise in participation rates. The June 2023 Module 1 saw a remarkable surge in attendance, with over 140 individuals joining the program. This represents a substantial increase compared to the previous year when we had 96 participants for the same module. The fact that more employees are actively seeking financial knowledge and taking part in the program is a testament to its impact and value.

The growing interest demonstrates that employees recognize the importance of financial savviness and are eager to enhance their financial well-being. The positive response from participants, as reflected in their comments and commitments to take action, further highlights their enthusiasm and motivation to apply what they have learned. Their willingness to reassess their spending habits, track their expenses, and adopt a new money mindset demonstrates a genuine desire for financial growth and empowerment.

“My key insight from the WIN session was, that I need to first change my money mindset. We’ve learned so many negative beliefs like ‘money is evil’ during our childhood. I need to recognize these beliefs and transform them into positive ones.” – Karin Althaus, Lead Strategic Brand & Content Management Vita, Participant

Participants are actively engaging with the program’s content and implementing positive changes in their financial habits, which will have a lasting impact on their financial future.

At Zurich Insurance, we recognize the value of collaboration and the power of community. That’s why we actively engage with women’s organizations, non-profits, and advocacy groups to expand the support network for women. By connecting women with additional resources and support systems, we foster a sense of community and empowerment. Since 2016, we have proudly been a member of Advance – Gender Equality in Business. As a responsible company, we are committed to establishing conditions for equality and advocating for the equal treatment and empowerment of all our employees. To symbolize this commitment, we recently unveiled our Advancine sculpture titled ‘The New Oath of the Three Swiss Confederates’ by Marco Michel at our Swiss headquarters in Zurich-Oerlikon. This artwork serves as a visual representation of our dedication to advancing gender equality and fostering an inclusive environment for all.

We are committed to empowering women and enhancing their financial independence not only in the present but also in the future. By providing women with the necessary tools, resources, and knowledge, we aim to equip them to navigate the ever-changing financial landscape and build long-term financial resilience.

Through ongoing research, continuous program evaluation, and feedback from participants, we will refine and enhance our program to ensure its effectiveness and relevance.

Together, we can create a future where women have the knowledge, confidence, and financial independence to shape their own destinies. By empowering women today and looking towards the future, we can contribute to a more equitable and financially secure society for all.

Saoirse Jones and Anna Frick have kindly agreed to discuss the topic of financial savviness further and provide a deeper insight into the WIN Financial Awareness Program. They can be reached at saoirse.jones@zurich.com and anna.frick@zurich.ch.

This Best Practice was first published in the Gender Intelligence Report 2023.

Unveil MSD Switzerland's Women's Network Leadership Academy, revolutionizing the path to gender parity. Join the empowering journey as women develop tools and leadership capabilities to shape their future as trailblazing leaders.

Embark on Accenture's transformative journey with their returnship program, EMBARK. Witness the normalization of career breaks, bridging the gender gap, and unlocking individuals' full potential, reshaping the future of work.

Involving employees pays off - learn what happens when the entire workforce sets the agenda for gender parity.

From speaker to role model - how to narrow the tech gap and attract more women to the industry.

UBS harnesses the power of their people and cultivates collaboration between the women’s employee network, the business and DE&I.

What happens if you put mentees in the driver's seat? Discover KPMG's tailored mentoring program's recipe for success.

How to engage the divisions in owning their diversity targets? Let them set their own!

Bain's 'We Care' programme is changing the culture of care-giving as more men take up flex leave options and extended paternity leave.

Accenture's thriving Working Parents' Network attracts 30% men in its membership.

The skywomen are empowered via mentoring in order to get involved in business decisions and shape the company future.

The 'Women at Bain' program, a strong network that acts as a support system to help women thrive during their careers.

A cross-divisional mentoring program connects women with more senior colleagues, increasing the bond between women internally and fostering belonging and career perspectives.